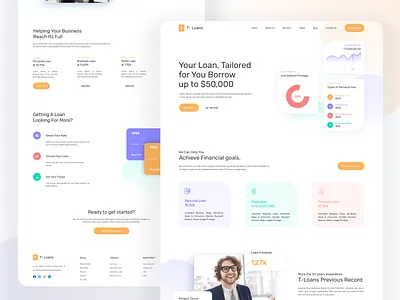

Unlock Your Financial Prospective With Convenient Funding Providers You Can Count On

In the world of personal finance, the accessibility of problem-free loan services can be a game-changer for individuals making every effort to open their monetary capacity. When looking for financial assistance, the integrity and credibility of the financing company are critical factors to consider. A myriad of financing alternatives exist, each with its own set of advantages and factors to consider. Comprehending just how to browse this landscape can make a substantial distinction in attaining your monetary objectives. As we explore the realm of problem-free fundings and trusted services even more, we uncover important insights that can empower individuals to make educated choices and protect a steady financial future.

Benefits of Hassle-Free Loans

Hassle-free financings use consumers a reliable and streamlined way to gain access to economic assistance without unnecessary complications or hold-ups. In contrast, problem-free fundings focus on rate and convenience, offering debtors with quick accessibility to the money they need.

Additionally, easy loans commonly have minimal eligibility requirements, making them accessible to a broader variety of people. Typical lending institutions often require extensive documentation, high credit report, or collateral, which can leave out several prospective customers. Hassle-free loans, on the various other hand, focus on price and versatility, supplying aid to individuals that may not fulfill the stringent demands of conventional economic organizations.

Types of Trustworthy Financing Services

Just How to Qualify for a Loan

Checking out the key eligibility requirements is crucial for individuals looking for to qualify for a loan in today's financial landscape. Supplying accurate and updated financial info, such as tax returns and financial institution declarations, is essential when using this article for a loan. By recognizing and satisfying these eligibility requirements, people can boost their opportunities of certifying for a finance and accessing the financial support they need.

Taking Care Of Loan Settlements Intelligently

When debtors effectively secure a funding by meeting the vital eligibility standards, prudent administration of funding payments comes to be vital for keeping monetary security and credit reliability. To handle funding payments sensibly, borrowers must produce a spending plan that includes the month-to-month settlement amount. By taking care of finance payments responsibly, debtors can not only fulfill their financial obligations however also construct a favorable credit history that can benefit them in future news economic ventures.

Tips for Selecting the Right Finance Alternative

Picking the most suitable lending alternative entails detailed research and consideration of individual financial demands and situations. To begin, examine your economic situation, consisting of revenue, expenditures, credit history, and existing financial obligations. Recognizing these factors will help you identify the type and amount of lending you can manage. Next off, compare loan choices from different lenders, consisting of traditional financial institutions, credit report unions, and online lenders, to discover the most effective terms and rate of interest prices. Take into consideration the funding's total price, settlement terms, and any kind of extra fees related to the car loan.

Moreover, it's crucial to select a car loan that straightens with your monetary goals. By complying with these tips, you can with confidence select the appropriate finance choice that helps you accomplish your financial goals.

Verdict

Finally, unlocking your financial potential with problem-free car loan services that you can rely on is a responsible and clever decision. By recognizing the advantages of these fundings, recognizing just how to get them, managing payments sensibly, and choosing the best car loan alternative, you can attain your financial objectives with confidence and assurance. Trustworthy loan solutions can offer the assistance you need to take control of your funds and reach your wanted outcomes.

Secured car loans, such as home equity loans or cars and truck title car loans, permit customers to make use of collateral to protect lower passion rates, making them an appropriate selection for people with useful properties.When borrowers efficiently safeguard a loan by satisfying the key qualification criteria, prudent monitoring of lending payments comes to be paramount for preserving monetary security and creditworthiness. By handling finance repayments sensibly, borrowers can not only satisfy their financial responsibilities yet additionally construct a favorable credit rating history that can benefit them in future financial ventures.

Think about the lending's overall cost, payment terms, and any type of extra costs associated with the funding.